The Carter Bank & Trust VISA Debit Card is a great way to manage your business expenses. We know that your business is your livelihood — and as your trusted financial partner, our goal is to provide you with dependable and accessible banking services so your company can thrive.

The Carter Bank & Trust VISA Debit Card is a secure banking option backed by our world-class customer service and fraud protection practices. Learn more about why this card is the perfect choice for your business below.

Benefits of the Carter Bank & Trust Visa Debit Card for Business

With your Carter Bank & Trust Visa Debit Card, you can make daily business purchases and cash withdrawals and link your business checking account, giving you a great way to manage your expenses. Along with no annual fees and Visa Zero Liability Protection, other free benefits provided with your Visa Debit Card include:

- Auto rental collision damage waiver

- Purchase security

- Extended warranty protection

- Travel emergency assistance services

Instant Issue Debit Cards

Your business can’t wait, and why should you? With Instant Issue the wait is over! Visit your local Carter Bank & Trust branch the next time you’re ready to open a new business checking account — you can receive your new card the same day. If you lose your card or even suspect fraudulent activity, simply stop in any one of our branches and we’ll issue you a new card.

It’s fast, simple and convenient — cards are issued on the spot, ready to use. Receive your card right away, without the worries or risk of your card being lost, stolen or compromised in the mail.

Contactless Payments and Digital Wallets

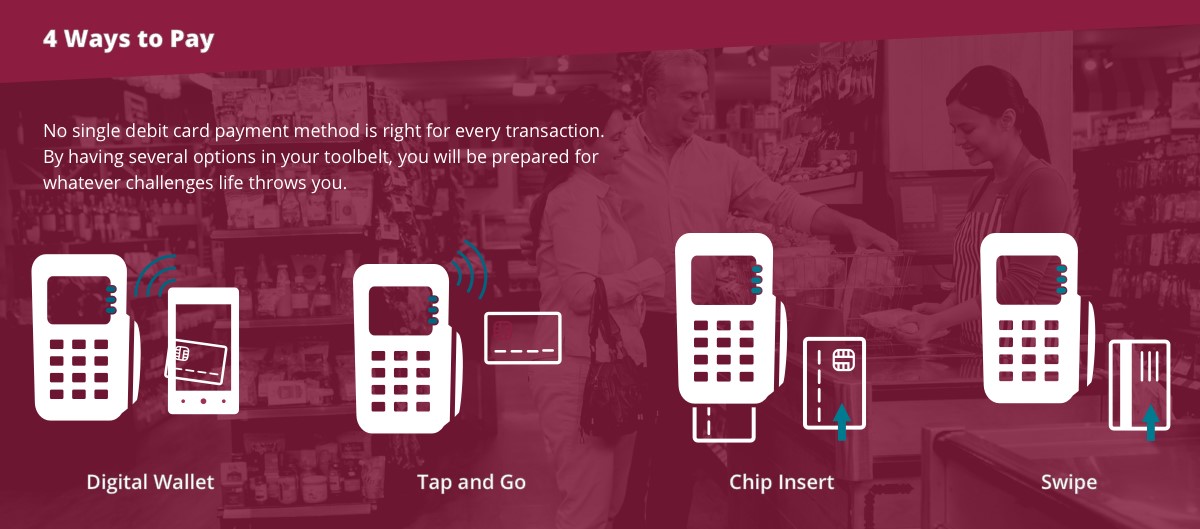

Today, there are more ways than ever to use your Carter Bank & Trust debit card to pay for goods and services. Each card is equipped with contactless chip technology to support the traditional swipe and chip insert payment methods. However, our business debit cards are also compatible with digital wallets, giving you the ability to add an electronic version of your card to your mobile device for use at checkout. All you have to do is tap a terminal and go — it’s just as simple as swiping your physical card, and can be more secure.

Learn more about contactless payments below.

Debit Card Fraud Alerts

Carter Bank & Trust’s Debit Card gives you a convenient, safer alternative to using cash and checks. With our debit card fraud monitoring notification system, we monitor card transactions 24/7 for suspicious activity, and offer two types of alert notifications when warranted: text messages and phone calls.

When potential fraud is detected, you will receive an automated fraud alert phone call from 800.279.2674. When you receive this alert call, you will be given prompts for action, including the option to speak with a person. These automated calls are sent automatically upon fraud detection, with no enrollment required.

Get a Carter Bank & Trust VISA Debit Card for Your Business Today

Carter Bank & Trust aims to provide secure, convenient banking services that can help take your business to the next level. Visit a Carter Bank location near you or contact us by calling 833.275.2228 or 833.ASK.CBAT to learn more about the Carter Bank & Trust Visa Debit Card and apply for your own card today.

Learn More About Contactless Payments with Your Visa® Debit Card

What is a contactless payment?

A contactless payment uses short-range wireless technology to make a secure payment between a contactless card or payment-enabled device and a contactless-enabled checkout terminal. When you tap your card or hold your device near the checkout terminal, your payment is sent for authorization.

What is a digital wallet?

In simple terms, a digital wallet is an electronic version of your physical wallet you carry. It stores your payment information in an online account. When you are making a purchase, you can use your digital wallet from your mobile device to provide information instead of presenting the card each time.

How do digital wallets work? Are they secure?

If you decide to add your card account number to a mobile device or digital wallet, our debit card provider, Visa, will issue a “token” or digital account number behind the scenes. Then when you initiate transactions with a mobile device, using this “token” or digital account number, not your debit card number, will be used to process the transaction, just like a traditional debit card payment. Because the “token” doesn’t carry your debit card number, you are less likely to become a victim of fraudulent activity.

How do I hold my card at checkout? What is the benefit of using a “tap and go” payment method?

It works best when your contactless card or device is held flat over the checkout terminal. While tapping is optional, your card or device just needs to be within 1-2 inches of the checkout terminal card reader.

Using a card that allows you to “tap and go” eliminates the wear and tear on your debit card due to excessive swiping and inserting of your card in merchant terminals. It also can be safer and more secure than swiping and inserting a chip. For example, it reduces the chances of dishonest merchant employees stealing your card’s magnetic-strip through “skimming,” – the practice of fraudulently procuring card data.

What are the advantages of contactless payments?

Contactless payments make shopping fast and easy, making them ideal for quick shopping experiences at places like restaurants, grocery stores, and more.

Contactless payments are secure because just like a chip card, each transaction is accompanied by a one-time code that protects your payment information.

Contactless payments provide an electronic record of your purchases and give you all the functionality of a Visa card, so you can add a tip and even get cash back (where available).